You aren’t investing in Africa — and you’re missing out

Cosmo City, a suburb of Johannesburg, South Africa and a stronghold of the continent’s growing middle class.

LONDON (MarketWatch) — If a financial adviser offered her clients a chance to invest in a country that expected economic growth of 6% or 7% a year for the next two decades, chances are the clients would jump at the prospect.

But once they found out that country was in sub-Saharan Africa, chances are a lot of them would lose their nerve.

With the Ebola virus ravaging the populations and economies of several West African countries, and armed conflicts claiming lives in Nigeria, Kenya and other nations, Africa continually generates the kind of headlines that make Westerners uneasy. And in the U.S. in particular, the continent barely appears on investors’ radar screens. David Snowball, publisher of the Mutual Fund Observer newsletter, estimates that only about 0.3% of the average portfolio in the U.S. — just $3 out of every $1,000 — is invested in Africa.

But more fund managers and economists believe it’s time for that to change. With a lot of factors falling into place at the same time — rapid economic growth, unprecedented political stability, and a young and increasingly middle-class population — the continent could be at the foothills of a promising upturn.

For investors with steady nerves, the bulls say, Africa offers an opportunity to reap a better return than they would in the “old” emerging markets — an opportunity to cash on greater growth than they can expect from, say, the BRICs or the MINTs. While economic growth and a rising stock market don’t always occur in tandem, some investors see the two creating a virtuous cycle in Africa.

“We believe that Africa could be the ‘emerging market’ story of the next decade,” said Mark Mobius, executive chairman of Templeton Emerging Markets Group and manager of the Templeton Africa Fund, in emailed comments. (Read an interview with Mobius here.)

Jim O’Neill, who coined the term BRIC (for Brazil, Russia, India and China) and is former chief economist at Goldman Sachs, is also investing in the region; among other moves, he personally bought a significant chunk of Pagatech, a Nigerian mobile-payment company, earlier this year. (Read Jim O’Neill: Short the euro, watch Apple and more tips.)

Of course, there’s no single, monolithic Africa to invest in. There are 48 countries in the sub-Saharan category, ranging from large and relatively stable democracies like South Africa to tiny, volatile dictatorships. Most of the continent’s stock markets are relatively new and expensive for outsiders to invest in, and risks — including financial and political corruption — abound.

In short, for most investors, African stocks are a speculative play with high rewards and high risks — not the kind of “core” investment you’d bet your nest egg on. As frontier-markets investor Thomas Vester puts it, if you can’t turn on CNN without getting freaked out, this isn’t a region for you. That said, a payoff could await the patient investor with a long time horizon who can ride out the impact of some bad headlines.

For more on how to invest in Africa, see these tips on mutual funds, ETFs and stocks.

A continent’s growth prospects

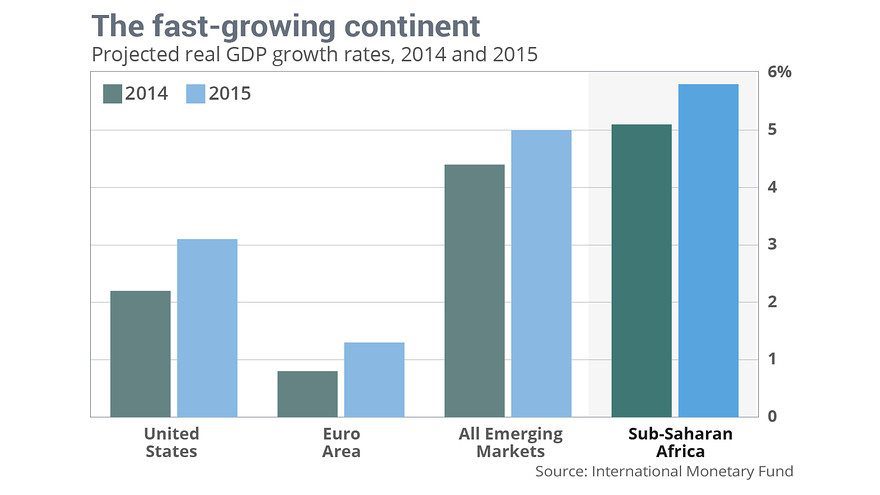

The International Monetary Fund estimates that the real GDP of sub-Saharan Africa as a whole will grow by 5.1% and 5.8% in 2014 and 2015, respectively, as foreign investments in natural resources, increased public spending on infrastructure and better agricultural production combine to help local economies accelerate.

Those are the kind of growth numbers that developed economies, and even other emerging markets, can only envy. The IMF in its most recent World Economic Outlook estimated that the U.S. economy will expand by 3.1% in 2015, while the euro area is forecast to produce growth of only around 1.3%.

Granted, it’s easier for underdeveloped economies to deliver eye-popping growth numbers, since they’re starting from a much smaller economic base than the developed world. Still, economists think many African countries can expect even more impressive growth than the average for the continent. Paul Collier, co-director at the Centre for the Study of African Economies at Oxford University says some African nations have the potential to double their economies over the next decade (which implies growth of over 7% a year, a rare accomplishment in the global context).

Collier cites Kenya, Rwanda, Tanzania and Ethiopia as potential doublers. “You’re looking at strong economic growth, reasonable economic management and favorable balance sheets,” in each of those nations, said Collier, who currently also is adviser to the Africa Region of the World Bank.

Source: International Monetary Fund

Favorable demography is helping to drive Africa’s growth. With the youngest population in the world, the region is in the economically fortunate situation of having a lot of people entering the workforce and very few retired people. In that sense it’s the opposite of Germany and Japan, where large populations of retirees are becoming a brake to economic growth.

In the strongest African economies, as the workforce expands, economists expect demographics to drive higher demand for services, goods, housing and infrastructure, which in turn will help drive domestic economies.

“The burgeoning middle class needs to be nurtured and supported, with a little help from prudent policy, and a constructive global economic backdrop,” said Mobius of Franklin Templeton.

Thomas Vester, overseer of $875 million at the LGM Frontier Markets fund BLGFX, -0.54% explained that political stability is another major factor in Africa’s growth prospects.

Country snapshot: Kenya

Category

2015 expected GDP growth 6.2%

Population 45 million

Top industries Agriculture, oil refining, tourism, manufacturing

Challenges Corruption, low infrastructure investment, terrorism

Stock index USE All-Share: 64 companies listed; up 23% YTD

Notable companies Safaricom (mobile network); East African Breweries; Equity Bank; Nation Media Group

Sources: IMF, CIA World Factbook, Bloomberg, FactSet

Where African government leaders in the past hesitated to commit to longer-term projects—such as infrastructure and housing construction — many now feel more comfortable with planning further ahead, because they don’t fear being ousted immediately, said Vester.

Vester pointed to Kenya, Ghana, Botswana and Zambia as countries that could benefit from this new political stability. “Factors like that will give [these countries] a serious liftoff, where they can enjoy 20 years of trend growth of around 6%-7%,” Vester said.

“Long-term, we believe, and studies show, that there’s a correlation between democratic transitions, stability and economic progress,” he added.

Feeding the world

With the global population expected to increase to 9.6 billion people by 2050, from a little over 7 billion today, concerns about future food shortages have found their way to the international agenda. The United Nations estimates that by 2030, global food demand will have increased by 50%, increasing the need for greater food production.

Africa is in a unique position to help solve the problem, and to profit from doing so. The continent holds around 50% of the world’s uncultivated land that’s arable (that is, suitable for growing crops). The World Bank estimated in 2013 that African farmers and agribusiness could develop a trillion-dollar food industry by 2030—compared with $313 billion in 2010—if they started putting more of that land to use.

While investing directly in African agriculture is difficult — Vester, for one, cautions against it — a booming farm sector could help drive broader economic growth, putting more spending money in the pockets of local consumers and boosting other industries. Vester expects this trend to play out particularly dramatically in Nigeria and Zimbabwe. “This will really drive demand and consumption in these countries for a very long time,” he added.

Where the middle class is growing

For years, the fastest-growing sectors in Africa have been natural resources and mining. But Western investing pros say that other industries will be bigger growth stories over the next few years. With rapid economic growth also comes a rising middle class that wants to go out, open bank accounts, buy branded groceries and, eventually, buy cars, houses and life insurance.

Africa’s biggest economy, Nigeria, is a prime example of this, with the middle class having grown by 600% between 2000 and 2014, according to data from South Africa’s Standard Bank, one of Africa’s largest banks. Other countries that are expected to see a significant rise in the number of middle-class families by 2030 include Ghana, Angola and Sudan.

Country snapshot: Nigeria

2015 expected GDP growth 7.3%

Population 177.2 million

Top industries Oil, telecommunications, agriculture, chemicals, food products

Challenges Corruption, lack of infrastructure, inefficient property-registration system

Stock index Nigeria All-Share: 193 companies listed; down 13% YTD

Notable companies Zenith Bank, Guaranty Trust Bank, Nigerian Breweries

Sources: IMF, CIA World Factbook, Bloomberg, FactSet

“The consumer goes from never getting a paycheck to actually getting one, and then goes out to spend money,” Vester said. “That’s usually where you make money.” He and other investors see some of the greatest opportunities in telecom companies, food and beverage companies and banks — all of whom can offer products and services to a new middle class.

The top holdings of LGM’s Frontier Markets Fund include the Guaranty Trust Bank in Nigeria, and Sonatel, a telecom provider in Senegal. Mobius’s Templeton fund also owns Guaranty Trust Bank, as well as Zenith Bank (also of Nigeria), Nigerian Breweries and South African telecom firm MTN Group.

Along with consumer products, Collier of Oxford pointed to the construction and infrastructure sectors as the next big thing. “That’s what’s been missing in Africa,” he said. “Anything that has to be built, whether it’s housing, infrastructure, electricity generation or railways,” he said.

Enduring problems

Africa investment bulls identify the biggest short-term threats to growth as political instability, corruption — and perhaps most notably, the fact that many of the continent’s resource-heavy economies are vulnerable to a slowdown in China.

Collier describes the African nations as messy democracies, where you “can’t expect too much” stability. That said, he thinks political conflict is “not going to be catastrophic” for the continent as a whole. Frontier-markets guru Mobius says corruption is still prevalent in Africa. But in his experience, “many government leaders are increasingly willing to talk about the problem openly, and seem to be working to find ways to stamp it out.”

And then there’s the risk of a shock from China. Growth has been slowing of late in that industrial powerhouse, and that could seriously bruise global prices for commodities — which still underpin the economies of many African nations.

In 2009, China took the top spot as Africa’s largest trading partner, surpassing the U.S., and in 2013 trade between the two reached $210 billion, compared with just $10 billion in 2000. China is the number-one trading partner of 15 African nations, according to data from the CIA World Factbook, and it purchases more than 40% of the exports from seven of those nations.

This means the world’s second largest economy could bring Africa down with it in case of an economic crash, Collier explained. “But of course if China crashes, it’s not just Africa that suffers,” he said. “Then invest on Mars.”

Next: How to invest in Africa.

Country snapshot: Zambia

Category

2015 expected GDP growth 7.2%

Population 14.6 million

Top industries Copper, emerald mining, construction, beverages, chemicals

Challenges Vulnerable to China slowdown, HIV/AIDS, market-distorting agricultural policies

Stock index LuSE All-Share: 24 companies listed; up 16% YTD

Notable companies Zambeef Products, Zanaco (Zambia National Commercial Bank), Mobile Transactions Zambia

Sources: IMF, CIA World Factbook, Bloomberg, FactSet

Source: Market Watch: